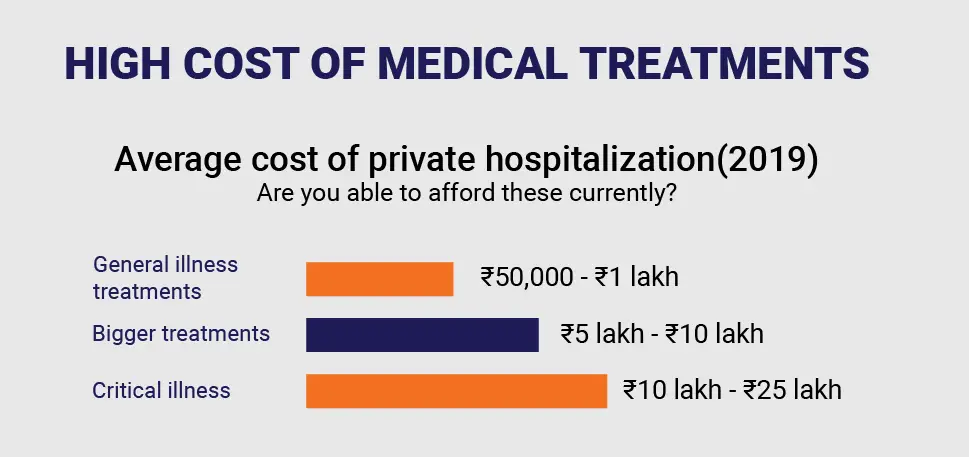

You can’t predict with which disease you could suffer in the future and its treatment cost.

Since health treatment costs keep on increasing with the evolution of health science technologies, the treatment of general illness in a private hospital is no less than Rs. 50K for a 1-2 days treatment.

The treatment is more costly in metro cities as compared to rural areas.

You can see the average cost of private hospitalization based on illness from general illness to the treatment of the critical diseases as below –

You must consider health insurance keeping future health treatment in mind and you can opt for a minimum of Rs. 5 lakh up to Rs. 25 lakh.

It’s better to get a small basic medical plan and a high top-up plan that would reduce your overall cost. We’ll discuss it in the buying guide at the end of this article.

The buying guide will help you understand important parameters that you should consider when buying family health insurance.

In this article, I have created 3 sections to let you educate completely about the family health insurance plans. The 3 sections are –

- Best family health insurance plans – That inculde best family floaters to cater different needs of a policyholder

- Best Top-up family health insurance policy – If you want to enhance the health insurance cover without spending much money. (We’ll discuss in details in the “Things to consider” section”

- Things to consider before buying family health insurance – A tiny 10-point buying guide that would cover important factors to let you make an educated decision.

Without any further fluff, let’s start.

Best Family Health Insurance Plans in India 2022

#1. HDFC ERGO Optima Restore Family Health Insurance Plan

HDFC’s ERGO (former Apollo Munich) Optima Restore is the best family floater for you if you want to cover modern treatments like robotic surgery, stem cell therapy, and oral chemotherapy, or any of the conditions below –

- Genetic disorders,

- Injury associated with hazardous activities

- Neurodegenerative disorders like parkinson, alzheimer, peritoneal dialysis.

Optima Restore is among a very few health insurance plans that cover modern treatment and disorders discussed above.

Apart from that HDFC Optima Restore also has 2 other major benefits –

A. Bigger Cashless Network

HDFC ERGOhas the highest hospital network of above 10,000 hospitals to avail cashless treatment that keeps you away from the hassle of multiple reimbursements follow-ups.

B. 100% Cover Restore

You also get 100% of your cover restored instantly after the first claim for future needs which means if you utilized your sum insured (even 100%), and you again need to hospitalize after a couple of months, you will get the 100% health insurance coverage again.

You get up to 180 days post-hospitalization expense cover which is higher among other peers.

You also get a 10% discount if you convert your Optima Restore individual plan into a family floater by adding 2 or more family members.

Features of HDFC ERGO Optima Restore Family Health Insurance Plan

| Features | Details |

| Sum Insured (Cover Amount) | Rs. 1 lakh to Rs. 30 lakh |

| Age Criteria | 18 years to Lifelong |

| Waiting Period (Named & Pre-existing) | Minimum 24 months up to 36 months |

| Pre and post-hospitalization period | 60 days and 180 days |

| Cashless Hospital Network | 10,000+ hospitals |

| Claim Settlement Ratio | 86.5% |

| No Claim Bonus | 100% additional policy cover as no claim bonus. |

Pros

- Covers Modern treatments like Robotic surgeries, stem cell therapy, and oral chemotherapy.

- Also covers genetic disorders, injury associated with hazardous activities.

- Neurodegenerative disorder cover that includes parkinson, alzheimer, peritoneal dialysis.

- High pre and post-hospitalization cover period

- Bigger cashless hospital network of above 10K hospitals

- 100% policy restore after the claim per policy year

- Daily cash benefit of up to Rs. 6,000 per hospitalization

- Preventive health check-ups up to Rs, 10,000 at the time of renewals

Cons

- No maternity or dental treatment cover

- No obesity or cosmetic surgery cover

#2. CARE Advantage Health Insurance Plan

CARE has the second-highest claims settlement ratio which is around 95.47%.

CARE (formerly known as Religare) has a large hospital network for cashless treatment. CARE Advantage family floater allows you to get an insurance cover up to 1 crore.

There’s no cap on ambulance charges, so you need not worry about the high ambulance fare in case of an emergency.

You also get unlimited room rent to get the best room or suite available while you or your family member is hospitalized.

The daycare treatments like Angiography and Chemotherapy are also covered in case any critical disease occurs suddenly.

Features of CARE Advantage Health Insurance Plan

| Features | Details |

| Sum Insured (Cover Amount) | Rs. 1 lakh to Rs. 1 crore |

| Age Criteria | 18 years to No limit |

| Waiting Period | Named illness – 24 months Pre-existing disease – 48 months |

| Cashless Hospital Network | 8,250+ hospitals |

| Pre and post-hospitalization period | 30 days and 60 days |

| Claim Settlement Ratio | 95.47% |

| No Claim Bonus | 10% of sum insured, maximum of 50% up to next 5 claim-free years |

| Co-payment charges | 20% if the policyholder is above 61 years old |

Pros

- Health cover up to 1 crore

- Strong cashless hospital network

- High claim settlement ratio

- Daycare treatment covers Angiography and Chemotherapy

Cons

- Low pre and post-hospitalization cover period

#3. Max Bupa Heartbeat Family Floater Plan

If you are looking for family health insurance with maternity benefits, then go with the Max Bupa Heartbeat plan.

Max Bupa Heartbeat plan offers you a claim of up to Rs. 1 lakh on baby delivery but after completion of 24 months of the policy. You can take maternity benefits two times only.

You also get a newborn baby insured in the same plan along with vaccination coverage.

The waiting period is 24 months which is less as compared to other peers who mostly offer 48 months waiting period.

You can get a sum insured of a minimum of 5 lakh and a maximum of 1 crore if you opt for the platinum plan.

The only drawback that I found is that the health cover starts from 5 lakh, so if you are interested in a small health cover amount (which is ideally not beneficial), you can’t opt for max Bupa is heart-protect of the high starting cover amount.

Features of Max Bupa Heartbeat Family Floater Plan

| Features | Details |

| Sum Insured (Cover Amount) | Rs. 5 lakh to Rs. 50 lakh (1 crore in Platinum plan) |

| Age Criteria | 18 years to no limit |

| Waiting Period (Named & Pre-existing) | 24 months |

| Cashless Hospital Network | 4500+ hospitals |

| Pre and post-hospitalization period | 60 days and 90 days |

| Claim Settlement Ratio | 89.46% |

| No Claim Bonus | 10% of sum insured |

| Co-payment | 10% and 20% (varies with the plan) |

Pros

- Maternity benefit cover

- Least waiting period among competitors

- New born baby cover from Day-1

- Vaccination expense also covered

Cons

- High starting sum insured amount that is Rs. 5 lakh

Check out – Best term insurance for 1 crore

#4. IFFCO Tokio Family Health Protector Plan

IFFCO Tokio family health protector plan has the highest claim settlement ratio which is 96.3% as per the IBAI report.

You can insure your health starting from Rs. 1 lakh that goes up to Rs. 30 lakh. The entry age for health insurance is 18 years and the maximum age is 65 years.

IFFCO Tokio Family floater allows you to cover not only your spouse, kids, or parents but also your in-laws, dependent siblings, and even your spouse’s siblings.

You may get a Daily Allowance of up to Rs. 1,000 per day in case of hospitalization extending above 3 days.

You can claim treatment at home (Domiciliary treatment) that goes up to 20% of the cover amount. So If you have a sum insured of Rs. 10 lakh, you can get a domiciliary treatment claim up to Rs. 2 lakh.

You also get cover for COVID hospitalization, AYUSH treatments like Ayurveda, homeopathy, and 121 surgical procedures like cataract surgery. However, the number of treatments covered is lesser than other companies.

Let’s go through other features of the IFFCO Tokio family health plan along with what is covered and not covered under the family health floater.

Features of IFFCO Tokio Family Health Protector Plan

| Features | Details |

| Sum Insured (Cover Amount) | Rs. 1 lakh to Rs. 30 lakh |

| Age Criteria | 18 years to 65 years |

| Waiting Period (Named & Pre-existing) | 48 months |

| Cashless Hospital Network | 5000+ hospitals |

| Pre and post-hospitalization period | 45 days and 60 days |

| Claim Settlement Ratio | 96.3% |

| No Claim Bonus | 5% of sum insured, maximum of 50% |

Pros

- Highest claim settlement ratio as per IBAI report

- Cover starts from as low as Rs. 1 lakh

- Home treatment cover is up to 20% of sum insured

- Daily allowance of Rs. 1,000 per day

Cons

- Maximum cover is low at 30 lakh

- Less number of daycare treatments covered

#5. TATA AIG Medicare Plan

Tata AIG medicare plan is ideal for people who want dental treatment to be covered. Along with that you also get coverage of 541 treatments (surgical and non-surgical) under daycare.

Another unique benefit of TATA AIG medicare is that you also get cover for bariatric surgery or weight loss surgery if that is recommended by the expert.

You can also opt for global treatment cover under the “Medicare Premier” plan.

TATA AIG offers complete planned global treatment insurance if any disease is diagnosed in India but the policyholder wants the treatment in a foreign country. Unlike other insurers that offer global treatment cover that works in an emergency only.

You also get a smaller waiting period of 36 months under Medicare Protect and 24 months under Medicare Premier.

You also get compassionate travel compensation of up to Rs. 20,000 if you have to travel to another city for treatment. If your minor kid is also staying in the hospital along with a patient, TATA AIG will pay you an additional cash allowance daily.

Features of TATA AIG Medicare Plan

| Features | Details |

| Sum Insured (Cover Amount) | Medicare Protect – basic plan with cover up to Rs. 5 lakh Medicare – Rs. 3 lakh to 20 lakh Medicare Premier – Rs. 5 lakh to Rs. 50 lakh |

| Age Criteria | 5 years to 65 years |

| Waiting Period (Named & Pre-existing) | 36 months in the ‘medicare’ plan 24 months in ‘medicare premier’ plan |

| Cashless Hospital Network | 7200+ hospitals |

| Pre and post-hospitalization period | 60 days and 90 days |

| Claim Settlement Ratio | 76.05% |

| No Claim Bonus | 50% of sum insured |

| Co-payment | 10% and 20% (varies with the plan) |

Pros

- Dental treatment cover

- Least waiting period under “medicare premier” plan

- Weight loss surgery (Bariatric surgery) cover

- Compassionate travel compensation of up to Rs. 20,000

Cons

- Global treatment cover only works in emergency situation

Also check – How to make smart investment portfolio

#6. Bajaj Allianz Health Guard Family Floater Plan

Bajaj Allianz Health Guard is ideal if the elderly member wants a complete family floater that insures their grandchildren as well. The Healthguard family floater plan covers grandchildren up to 35 years of age.

The plan also covers the treatment of Hernia, Piles, and joint replacement.

You can get a medical cover of up to 1 crore under the platinum plan. Platinum and gold plans also offer maternity cover (after 72 months waiting period) and weight-loss surgeries.

You get ambulance cover of up to 20,000 which is the highest among the others.

Features of Bajaj Allianz Health Guard Family Floater Plan

| Features | Details |

| Sum Insured (Cover Amount) | Silver plan – basic plan with cover up to Rs. 2 lakh Gold plan – up to Rs. 50 lakh Platinum plan – up to Rs. 1 crore |

| Age Criteria | 18 years to 65 years |

| Waiting Period (Named & Pre-existing) | Minimum 24 months up to 36 months |

| Cashless Hospital Network | 5000+ hospitals |

| Pre and post-hospitalization period | 60 days and 90 days |

| Claim Settlement Ratio | 76.05% |

| No Claim Bonus | 10% of sum insured up to 100% |

| Co-payment percentage | 20% |

Pros

- Joint family cover that includes grandparents to grandchildren

- Only 36 months waiting period for pre-existing disease

- Up to 1 crore health cover available under Platinum plan

- Maternity cover

- Daily cash benefit if minor is staying in the hospital

- Covers treatment of Hernia, Piles and joint replacement

Cons

- Less number of daycare treatments covered

- Maternity cover starts after 6 years of waiting period

- AYUSH treatment not covered under sliver plan

Also check – Best instant loan app without salary slip

#7. Star Family Health Optima Insurance Plan

You can go with Star Family Health Optima if you or your spouse requires Assisted Reproduction Treatment. The health optima plan will provide insurance up to Rs. 2,00,000 after a waiting period of 36 months.

Star Family Health Optima also offers automatic restoration of the sum insured after the first claim but what makes it different from others is that the sum insured gets restored 3 times at 100% each time if the cover is above 3 lakh.

Star network also has 10,000 plus hospitals attached for cashless treatment which is another plus point.

Health optima plan also covers air ambulance charges and you get 10% of the sum insured but the condition is you must have a policy cover of 5 lakh and above.

You also get compassionate travel compensation (including air travel) that includes a policyholder, a travel companion, and the next family member. The condition is you should have the sum insured is 10 lakh or above and the next family member travel expense is capped at Rs. 5,000.

Features of Star Family Health Optima Insurance Plan

| Features | Details |

| Sum Insured (Cover Amount) | Rs. 1 lakh to Rs. 25 lakh |

| Age Criteria | 18 years to 65 years |

| Waiting Period (Named & Pre-existing) | 48 months (36 months for assistive reproduction plan) |

| Cashless Hospital Network | 10,000+ hospitals |

| Pre and post-hospitalization period | 60 days and 90 days |

| Claim Settlement Ratio | 78.62% |

| No Claim Bonus | 100% additional policy cover as no claim bonus. |

Pros

- Assisted Reproduction Treatment of up to Rs. 2,00,000

- Standard AC room rent provided for sum insured above Rs. 5 lakh

- Free health check-up for every claim-free year

- Road and air ambulance cover

- Compassionate travel cover that includes patient, companion and next family member

Cons

- Vaccinations not covered except Anti-rabies

#8. ManipalCigna Prohealth Insurance Plan

ManipalCigna Prohealth is also a good insurance policy for you if you want maternity cover (up to 2 lakh INR) that starts after 48 months of policy issued. You can take benefits up to 2 deliveries.

You also get a newborn baby cover with 1st-year vaccination expenses.

Another benefit of the Prohealth insurance plan is that you get the option of ‘Second opinion’ from any specialist doctor covered once every policy year.

ManipalCigna offers 200% additional policy cover as a No-Claim Bonus which means your policy cover may extend to a maximum of 200% for claim-free years.

Features of ManipalCigna Prohealth Insurance Plan

| Features | Details |

| Sum Insured (Cover Amount) | Up to Rs. 25 lakh |

| Age Criteria | 18 years to 65 years |

| Waiting Period (Named & Pre-existing) | 48 months |

| Cashless Hospital Network | 6,500+ hospitals |

| Pre and post-hospitalization period | 60 days and 90 days |

| Claim Settlement Ratio | 85.72% |

| No Claim Bonus (NCB) | 200% additional policy cover as no claim bonus. |

Pros

- Maternity benefit cover up to 2 lakh

- 200% additional policy cover as NCB

- New born baby cover from Day-1

- 1st year vaccination expense covered

- 500 plus daycare treatments like cataract surgery

- ‘Second opinion’ option is covered once every policy year

Cons

- High waiting period of 48-months for pre-existing ailments

Best Top Up Family Health Insurance Policy

#9. ICICI Health Booster Super Top Up Policy

ICICI health booster super top-up plan starts from Rs. 5 Lakh and you can enhance the health cover up to Rs. 50 lakh.

Health booster comes with 3 deductible options – Rs. 3 Lakh, Rs. 4 Lakh, and Rs. 5 Lakh.

You also get a daily cash allowance of up to Rs. 3000 per day if hospitalized for more than 3 days

Features of ICICI Health Booster Super Top Up Policy

| Features | Details |

| Sum Insured (Cover Amount) | Starts from 5 lakh to Rs. 50 lakh |

| Deductible options | 3 lakh, 4 lakh, 5 lakh |

| Age Criteria | 18 years and above |

| Waiting Period (Named & Pre-existing) | 48 months |

| Cashless Hospital Network | 6500+ hospitals |

| Pre and post-hospitalization period | 60 days and 90 days |

| Claim Settlement Ratio | 78.67% |

| Co-payment clause | 20% if age is above 60 years |

Pros

- Cover starts from 5 lakh up to 50 lakh

- 3 Deductibles options available

- Daily cash allowance of up to Rs. 3000 per day

Cons

- Fixed deductible options

#10. Care Enhance Super Top Up Plan

Care Enhance is another super top-up policy that allows you to maximize your health cover up to 55 lakh.

Unlike ICICI, Care Enhance has flexible deductible options that vary from Rs. 1 lakh up to 10 lakh to select the deductible amount you can afford to pay.

Another benefit is you need not undergo any pre-medical checkup up to 40 lakh cover till 50 years of age.

However, Care Enhance doesn’t include “Alternative treatment” like Ayurveda, Homeopathy, a major con.

Features of Care Enhance Super Top Up Plan

| Features | Details |

| Sum Insured (Cover Amount) | Up to Rs. 55 lakh |

| Deductible options | Flexible – 1 lakh to 10 lakh |

| Age Criteria | 18 years and above |

| Waiting Period (Named & Pre-existing) | 48 months |

| Cashless Hospital Network | 8,250+ hospitals |

| Pre and post-hospitalization period | 30 days and 45 days |

| Claim Settlement Ratio | 92.83% |

| Co-payment clause | 20% if age is above 60 years |

Pros

- High insurance cover up to 55 lakh

- Flexible deductibles options that starts from 1 lakh

- High claim settlement ratio

- Bigger cashless hospital network

- No medical checkup up to 50 years age

Cons

- Low pre and post-hospitalization cover period

10 Things to Consider Before Buying Family Health Insurance

#1. What’s Covered and What’s not Covered

A. What’s covered

Most of us are aware of what we need in our health insurance, but sometimes we can skip any important feature at the time of buying and regret it later.

I am sharing with you a list of the most common benefits covered by the majority of insurance companies as below –

- Spouse, dependent kids, dependent parents or in-laws parents

- COVID-19 treatment

- Daycare procedures

- Pre-hospitalisation & Post-hospitalisation expenses (always look for larger time period)

- In-patient hospitalisation coverage such as room charges, doctor’s fee

- Organ donor expense cover

- Ambulance charges – Road & Air ambulance

- Alternative treatments like Ayurveda, Homeopathy, Unani that comes under AYUSH

- Domiciliary expenses

- Health check-up cost – only after a couple of claim free policy years

B. What’s not covered

When we search for an insurance plan we focus on the things covered under the policy but miss what points are not covered which could turn into a big mistake.

Treatments like dental treatment, psychological disorder, sexually transmitted disease, intentional self-injury, AIDS are some examples of non-covered treatments in most health insurances.

Another example, some policies don’t cover maternity expenses but some cover after 24 months of the waiting period, if you are planning a child after 2-3 years, do look for whether the maternity expenses are covered or not.

Some insurance policies cover dependent in-laws whereas some don’t. That could also be a considerable reason for you.

Make sure to understand what is not covered in the policy in the first place.

Here’s the complete list of things that are not mostly covered in health insurance plans –

- Maternity expenses

- Dental treatment

- AIDS, venereal illnesses and sexual transmitted diseases

- Medical treatment for behavioural, and psychiatric disorders

- Treatment of self-inflicted injuries because of a suicide attempt

- Treatment of Congenital External Disorders or anomalies such as cerebral palsy, down syndrome.

- Coverage for expenses incurred on vaccination

- Cosmetic or plastic surgery

- Cost of nutritional supplements, hearing aids, spectacles and contact lens, walker or crutches

- Treatment due to consumption of intoxicating substances like smoking, drugs/alcohol, and tobacco chewing

- Experimental, unproven and unconventional therapies.

- Hospital registration charges, record charges, telephone charges, & admission charges

- Stem cell therapy, and procedures using Platelet Rich Plasma

- Adventure sports injuries

- Injuries due to nuclear war, or any other war conditions

- International treatment cover

#2. How Much Cover Required

You must consider health insurance keeping future health treatment in mind and ideally you should go for a minimum of Rs. 5 lakh up to Rs. 25 lakh.

You should go for a small basic medical plan and high top-up plan that we’ll discuss in the next point.

#3. Top-up Policy

A top-up plan is a health insurance policy that only covers treatment costs after crossing a certain threshold. Treatment cost up to the threshold limit is called deductibles that are borne by the policyholder.

A top-up plan makes health insurance cheaper because it reduces the insurance company’s liability.

For example, buying a top-up plan that covers medical treatment starts from Rs. 5 lakh up to 25 lakh at around Rs. 15,000 per year.

That means your health cover will start when the medical treatment would cross the 5 lakh amount and any treatment amount below that you would pay.

If you get a regular family floater up to Rs. 25 lakh that may cost you Rs. 40,000 per year means top-up is cheaper than going for a regular plan.

Even if you buy a small regular health insurance plan of up to 5 lakh that would cost you around Rs. 13,000 to 15,000 per year and a top-up of Rs. 25 lakh with premium would be around Rs. 15,000 per annum.

Now the total cost you have to pay would be in the range of Rs. 28,000 to 30,000 which is still lesser than paying Rs. 40,000 for a regular family floater.

Remember, you don’t have to buy a top-up policy from the same insurance company from which you have got your regular family floater, you can buy a top-up plan from any of the insurance companies you like.

You can even buy only a top-up policy(without having any regular health plan) if you think you can afford the basic cover but require a high-amount family cover.

Ideally, go with a small regular family health plan like Rs. 5 lakh and add a top-up plan that would cover high medical treatment up to Rs. 25 lakh (or whatever you feel secure amount) without paying much premium.

#4. Age Criteria

Age criteria is another important factor that you should keep in mind because the insurance premium is fixed depending on the age of the eldest member of the family.

If you have dependent parents, it’s beneficial to go for a family floater for your family and buy individual health plans for parents because buying a group family health insurance would increase the premium amount.

Some health insurance plans have an entry age of 91 days to 65 years whereas some don’t have any age restrictions. You have to keep an eye before buying health insurance.

#5. Waiting Period

The waiting period is the time during which you can’t claim health insurance benefits. Every insurance company has some waiting period which could be around 24 months to 48 months.

Get clarity about the waiting period and go with the minimum waiting period policy.

#6. Cashless Claim Benefits

You may get an insurance claim in two ways –

- Cashless – You don’t have to pay for the treatment at the hospital, the company directly pays the hospital for your medical expenses as per the policy.

- Reimbursement – You have to pay the medical expenses at your level first and then claim the amount from the company later on.

The reimbursement process could be time-consuming and may require a lot of follow-ups. So always go with an insurance company having a maximum cashless network or make sure the hospital you seek treatment should be in the cashless treatment list of your insurance company’s network.

#7. Pre and Post Hospitalization Coverage

All health policies cover hospitalization charges, but you should look for pre and post-hospitalization charges like ambulance charges, pre-and post-treatment medical tests, and whether OPD fees are covered.

Go with the policy that covers maximum pre/post-hospitalization charges.

#8. No-Claim-Bonus aka No-Claim-Discount

No claim bonus (NCB) is a bonus that a health insurance company offers for each year you didn’t apply for the medical claim.

NCB offers an increase in the Sum assured (policy cover) amount for each claim-free year.

For example, if your health cover is Rs. 5 lakh and you didn’t make any claim in the first year you may get an NCB of Rs. 50,000 and your sum assured amount would be Rs. 5.50 lakh.

Search for the high NCB bonus offered by the insurance company.

#9. Co-Payment Clause

You may find the “Co-payment” clause confusing and think of skipping it as it seems less important. But that’s not the case.

Co-payment is the amount that you have to pay at the time of claim and the rest of the amount is top-unpaid by the insurance company.

A co-payment clause mostly occurs if you have any pre-existing disease like heart disease and you want a health cover. Insurance companies may ask you for a co-payment of 20% or 25% and the rest would be paid by them.

Go with no “Co-payment” clause or the one that has the lowest co-payment percentage.

#10. Claim Success Ratio

Claim success ratio (CSR) means how many claims an insurance company has successfully approved. A higher claim success ratio means an easier & faster claim process.

Always go with a high CSR percentage to avoid a hassle in the claim process. CSR value above 85% is considered to be good.

Conclusion

HDFC Ergo Optima Restore is one of the best mediclaim policies that ensure 100% sum insured restore to utilize your policy cover twice in the same year and provides cover for modern treatment like robotic surgery or stem cell therapy.

If you need a high cover and high CSR insurance plan, then go with Care Advantage that offers you up to 1 crore cover and has a higher CSR percentage of 95%. You also get a bigger network of 10000 plus hospitals for cashless treatment.

If you are looking for a top-up policy to increase your insurance cover, you can go with Care Enhance Super Top-up as you get up to Rs. 55 lakh cover but also has a flexible deductible option starting from 1 lakh that allows you to decide the amount that you can afford before the insurance company starts paying up.