An investment portfolio is the collective of all the investments that a man makes throughout his life, be it real-estate, mutual funds, cash, commodities, or cash equivalents.

But a smart investment portfolio helps you in 3 ways –

- Lets you to create a passive income source

- Offers long-term financial protection

- Helps in building wealth in the long run

Let’s discuss how to make a smart investment portfolio in 5 easy ways.

How To Make A Smart Investment Portfolio (in 5 Easy Ways)

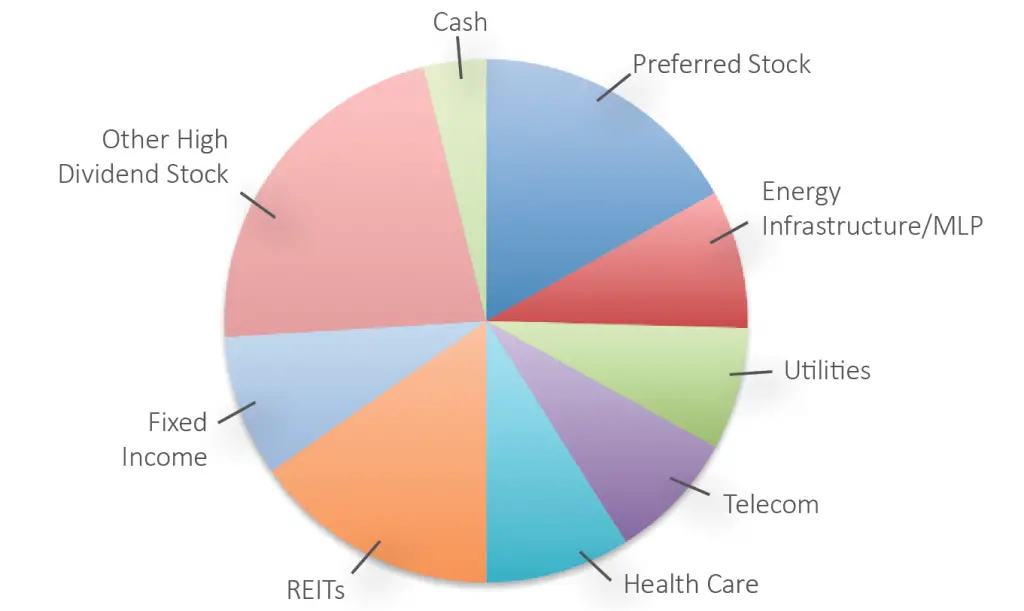

#1. Diversify Your Investments

According to this trick, you should never put your money into a single stock or only in one sector. It would be one step ahead for you if you invest them towards many other stocks on which you have trust.

But remember one thing that as it is said to invest in multiple stocks that doesn’t mean you are going to steep all your money in 70 to 80 different stocks. You just have to invest in around 20 to 25 different stocks. For starters, consider checking out infinox minimum deposit to find out more investment options in the stock market.

Don’t ever assume what others will utter about you. You decide to take a quite big risk to earn a massive amount of capital as well as to grasp knowledge about different stock sectors. But if you are not able to make a good amount of money in this way then you should not risk your wealth every time. As it is mentioned above it has a lot of risk factors when you invest in different stock sectors.

#2. Invest According to DCA

Dollar-cost averaging (DCA) is an investment approach in which you invest in a particular asset or stock in installments in an effort to reduce the effect of market fluctuation on the overall purchase.

The DCA technique mainly helps the investors to invest their wealth in a very systematic order.

The best thing of DCA is that in most cases this technique has saved a lot of money for the investors when they have faced a loss in their stock account.

Check out – Best banks for personal loan

#3. Always Stay Updated about the Market

You might be using various stock market techniques like “dollar-cost averaging” or “buying and holding”, but you should always be updated about the level of the market. Because if you are aware of it then you will easily know the perfect time to sell and buy the stock when the market is down, that would help you buy undervalued stocks and sell stocks when those are at peak to book profits.

For a good investor, the best time to make a profit with their stock is the time when they have reached your expected return percentage. And when the market is in downfall, that’s the only time when you can buy the new ones at better prices to make higher yields in the future and the market corrects.

You should always be patient while you are trading when the market is down because it can even be challenging for you to make a profit during that period.

#4. Make Long-Term Investments

If we say to make a long-term investment that will never mean that short-term investments are wrong or they don’t attain profits. But if you want to make a better portfolio and even want to earn a huge amount of money through stock then you should go ahead with long-term investments.

The other reason to choose long-term investment over the short term is that for the new investors who want to invest in short terms they will require a support system like a stock agent where they will even pay them their requested amount.

But in the long term, you just have to choose a popular brand stock and get the fundamental knowledge about its business and invest in them. In order to get an idea try reading exness review which will help you orient yourself in stocks. You will also not require any kind of external help for your investment to which you will pay extra charges.

Long-term investments are the best way to improve your portfolio and even to earn a great amount of money with less amount of risk and loss.

Also read – Best microfinance companies

#5. Track Your Investment Performance

Once you have completed your investments for a longer period you should track the performance of your investment which you have done in the last few periods. By keeping a track record of your investments, it will help you achieve your financial goals. This is the best way to make a better portfolio performance

Suppose, after analyzing your portfolio performance it is not up to the benchmark which you have decided. Then you should analyze the reasons behind not achieving your benchmark and once you get to know about all the reasons which have been the barrier to your better portfolio performance, try to avoid those same mistakes for the other time.

Tracking your investment is one of the best ways to improve your skills as well as your capital.

Also check – Best 1 crore term insurance plan in India

Conclusion

So we have discussed 5 strategies that will add to the betterment of your investment portfolio. A smart portfolio can make a huge difference while keeping accounts of lifetime investments.

These techniques will help you in being keen on all the essential aspects of investment. Making a wrong investment can stake all your assets.

Stocks and shares have their share of risks; however, a strong smart play can reduce this risk to negligible. Always be updated with your portfolio to achieve the success for which you are hustling.