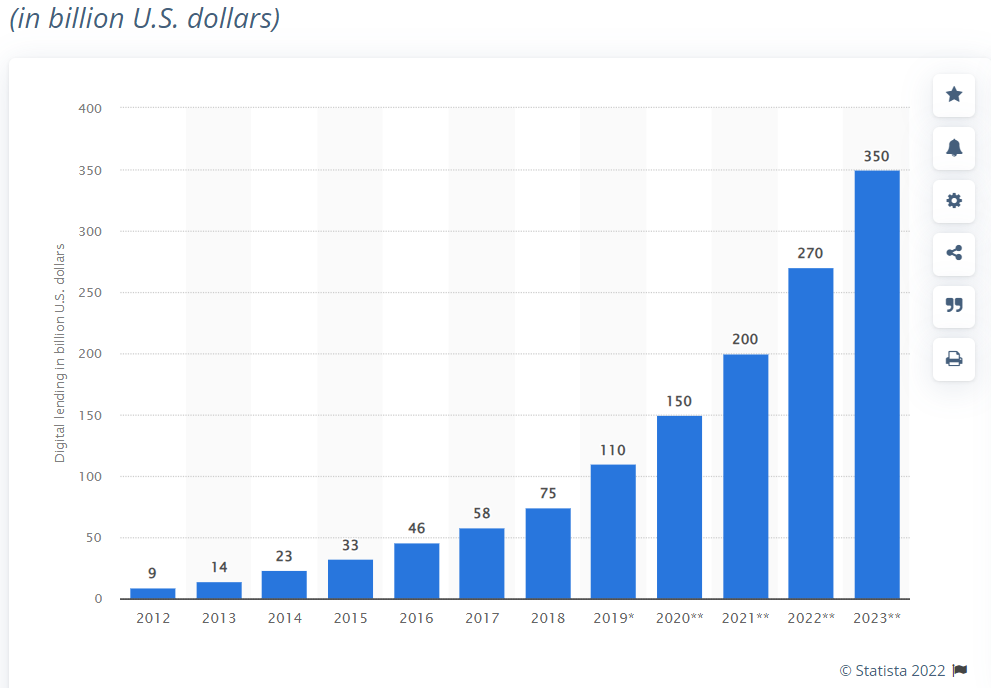

According to Statista’s report, the Indian digital loan market is on a boom that would touch 350 billion USD in 2023.

The reason is many fintech platforms are now intermediating between the end customer and banks or NBFCs to provide hassle-free loans through smartphone apps without any need of going physically to any bank.

You can even get a loan without providing the salary slip and some apps like Simpl don’t even require KYC verification.

We have shortlisted the 7 best instant loan apps (without salary slip) based on the checklist shared below –

- Interest charges

- Maximum loan amount available

- Ease of applying

- Processing fee

- Late fee

- Prepayment charges

- App rating (both on Google Play & Apple AppStore)

Let’s discuss the 7 best instant loan apps in India that don’t need a salary slip.

7 Best Instant Loan App in India without Salary Slip in 2022

#1. MoneyTap

| Maximum Loan Amount | Rs. 5 Lakh |

| Interest Charges | 15% to 36% |

| Processing Fee | 2% |

| Joining Fee | Rs. 500 |

| Late Fee | 15% of the due amount |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | 3% of the balance amount |

| Google Play Store Rating | 4.2 |

| Apple’s App Store Rating | 4.3 |

You can get quick approval for a credit line starting from Rs. 3,000 up to Rs. 5 lakh (displayed as MoneyTap Balance) and you pay interest only on the amount you withdraw from your MoneyTap balance.

If your CIBIL score is good, you can get a lower interest rate starting from 15% which can go up to 36% for high-risk-profile customers. You can opt for a repayment tenure anywhere between 2 months and 3 years.

MoneyTap offers loans to both salaried (having a minimum Rs. 13,000 monthly salary) and self-employed people with Rs. 20,000 as monthly income.

You have to mention your source of income (company name & address if salaried or business type and address) while signing up but you don’t need to produce the salary slip. They will verify your CIBIL score and KYC for the loan approval.

You not only can transfer the loan amount to your bank account but also make UPI payments directly from the credit line available in the app. Moneytap is connected with several NBFCs and banks for personal loan issuance. Banks like HDFC, RBL are attached with Moneytap.

MoneyTap comes with 15% late payment charges (min Rs.350 and max Rs.1000) on the total due amount if you miss your EMI.

Pros

- Instant loan facility

- Get higher credit line approved instantly

- Lower interest rate

- Pay interest only on the used amount

- Use credit line for UPI payments

Cons

- Don’t offer loans to a variety of small businesses like vendors, gym instructors

#2. Kissht

| Maximum Loan Amount | Rs. 2 Lakh |

| Interest Charges | 14% to 30% |

| Processing Fee | 2% to 9% |

| Joining Fee | Rs. 240 |

| Late Fee | 3.5% of the due amount |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | Zero |

| Google Play Store Rating | 4.5 |

| Apple’s App Store Rating | 4.6 |

You can easily get an instant loan between Rs. 1,000 to Rs. 2,00,000 with the Kissht app.

The best part is you don’t need to produce your salary slip making it ideal for college students, freelancers, and shop owners. Because Kissht doesn’t require the credit score to give you the credit line.

In the first dealing, you get 15 days repayment period that increases to 62 days if you repay on time, and later on, you can pay back the loan in 15 months at max.

Initially, you get a low credit line and that would keep increasing if you repay your loan in time. You can get a loan at as low as 14% depending upon loan amount & period which is low as compared to other instant loan apps. The maximum interest rate is 30%.

Kissht is partnered with Si Creva Capital Services Pvt Ltd, an RBI registered NBFC (a microfinance company) to provide you with your digital loan. They claim to provide instant loans, however, it takes 4 to 5 days to get the loan amount transferred to your bank account which could be a turn-off for some people.

Pros

- Low-interest rates as compared to other loan apps

- Offers loans to small vendors, shopkeepers, and freelancers

- QR scanner facility to scan and pay just like UPI payments

Cons

- Slow loan disbursement

- Small maximum loan amount limit

- Initial loan tenure is very low

- Processing fee is high

#3. Smart Coin

| Maximum Loan Amount | Rs. 1 Lakh |

| Interest Charges | 15% to 36% |

| Processing Fee | 4% to 5% |

| Joining Fee | Rs. 240 |

| Late Fee | 3.5% of the due amount |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | 2.5% to 4% of the balance amount |

| Google Play Store Rating | 4.4 |

| Apple’s App Store Rating | N.A. |

What I liked about the Smartcoin app is the facility of prepayment of the loan without any additional charges, which means if you have got some additional income, you can close your loan without paying any preclosure charges.

The smart coin doesn’t have any minimum salary requirement, so even if your monthly income is low, you can still avail of the loan in case of urgency. Because most apps don’t offer loans to low-income group people.

If you need a small loan amount up to Rs. 1 lakh, then go with the smart coin app because you get instant loan approval depending on your risk profile. Your risk profile is measured based on your credit score.

If you don’t have a CIBIL score, you would still be able to get a loan from SmartCoin but the amount would be restricted to a few thousand rupees (vary from Rs. 1,000 to Rs. 20,000) initially. However, a good credit score and regular monthly income improve your chances of getting a higher loan amount.

You can repay the loan within a maximum period of 1 year but the important thing to keep in mind is the interest rate is very high at 36% per annum.

You also earn reward coins called smart coins for using the app and repaying your loan in time. You can use these coins to reduce the processing fee in the future.

Pros

- Offer credit line to low-income group

- Instant loan disbursal

- No prepayment and foreclosure charges

- No credit score required

- No monthly income required

Cons

- High-interest rate at 36%

- High processing fee

- Only up to Rs. 1 lakh loan available

- No iPhone app

Also read – Best family health insurance plans in India

#4. Simpl

| Maximum Loan Amount | Rs. 1 Lakh |

| Interest Charges | N.A. |

| Processing Fee | 2% to 9% |

| Joining Fee | Rs. 240 |

| Late Fee | Up to Rs. 250 |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | Not Allowed |

| Google Play Store Rating | 4.1 |

| Apple’s App Store Rating | 4.4 |

If you don’t require big loans but need some credit line for your everyday expenses without sharing your information online, then go with Simpl because of 2 unique features –

- Simpl doesn’t require KYC verification during account opening

- Simpl doesn’t share your personal information to merchant sites

Since your personal information is not shared with the merchants, making it a secure way to avoid the chances of happening any online fraud.

You get a small credit amount like Rs. 3,000 initially that keeps on increasing depending upon your repayment and behavior analyzed based on your spending habits.

You get 15 days to repay your credited amount which means anything purchased between the first of the month to 15 of the month you have to pay the bill on the 15th of the month and the bill date of purchases and there are no hidden charges applicable, Simpl keeps everything transparent.

However, Simpl charges a late fee starting from Rs. 11 to Rs. 250, if you don’t pay the credit bill within 5 days of bill generation. If you miss the next billing cycle as well, then 2nd late fee also gets added to your credit bill.

Simpl has now introduced the Pay-3 feature, which allows you to pay your billing amount in 3 no-cost EMIs without any hidden charges applicable.

Pros

- No KYC required

- Interest-free loan with 2 EMIs per month

- New Pay-3 feature to split the bill into 3 No cost EMIs

- No hidden charges

- User interface is super-friendly

Cons

- No high amount loan available

- Credit line amount is not bank transferrable

#5. Lazy Pay

| Maximum Loan Amount | Rs. 1 Lakh |

| Interest Charges | 15% to 25% |

| Processing Fee | 2% |

| Joining Fee | Zero |

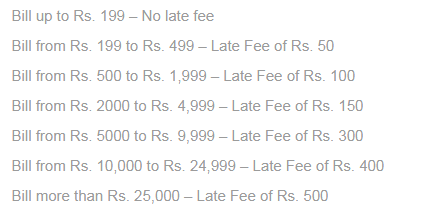

| Late Fee | Up to Rs. 500 |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | Not Allowed |

| Google Play Store Rating | 4.4 |

| Apple’s App Store Rating | 4.8 |

LazyPay is among the best personal loan app in India that offers you instant credit in a few clicks.

LazyPay has a tagline “Buy now, pay later”, which means you can use lazy pay for your current payments and get 15 days interest-free period to pay back. Means for using a credit line, you get 2 dates to pay the amount that is 1st and 15th of every month. The best part is there are no hidden charges in it.

You can convert any credit amount above Rs. 3,000 into EMIs.

You can also get up to Rs. 5 lakh credit line from which Rs. 1 lakh would be transferable to your bank account but you have to pay a processing fee of 2% and an interest rate in the range of 18% to 25% per annum on the transferred amount. You can repay the loan amount in a maximum of 2 years period.

The late fee starts from Rs. 11.8 per day and goes up to Rs. 500 depending upon the credit amount (as shown below).

Pros

- Instant credit line facility

- 15-day interest-free period

- Low APR rates

- Cashback offers on spending

- Easy to use app interface

Cons

- Loan tenure is 15 days only

- Late fee applied on per day basis

Check out – Best term insurance plan for 1 crore

#6. Dhani Card

| Maximum Loan Amount | Rs. 15 Lakh |

| Interest Charges | 18% to 30% |

| Processing Fee | 3% |

| Joining Fee | Rs. 500 |

| Late Fee | 3.5% of the due amount |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | Not Allowed |

| Google Play Store Rating | 4.2 |

| Apple’s App Store Rating | 4.3 |

Dhani Card app allows you to pay in 3 interest-free installments for an instant credit line starting from Rs. 10,000 to Rs. 5,00,000.

Dhani is best for you if you need a high amount of personal loan of up to Rs. 15 lakh, but you need a very high CIBIL score (above 800), and your repayment history should be excellent. The interest rates start from 13.99% for a low-risk profile customer.

You can also apply for the Dhani freedom card through the app that comes with a monthly subscription fee of Rs. 199/month but no interest is charged on your monthly spending (credit line is restricted to Rs. 5 lakh).

Pros

- High loan amount of Rs. 15 lakh also available

- Split your credit amount into 3 interest-free installments

- Use Dhani Freedom card to enjoy no-interest credit line

- Cashback offers on spending through card

- One stop shop for buying medicines or trading in stocks

Cons

- No clarity about APR

- 3% processing fee

- Freedom card comes with a recurring expense of monthly subscription

- Poor customer service

#7. Mpokket

| Maximum Loan Amount | Rs. 30,000 |

| Interest Charges | 24% to 72% |

| Processing Fee | 2% |

| Joining Fee | Rs. 200 |

| Late Fee | 3.5% of the due amount |

| Prepayment Charges | Not Allowed |

| Foreclosure Charges | Not Allowed |

| Google Play Store Rating | 4.2 |

| Apple’s App Store Rating | N.A. |

You are a college student wondering if you can get a loan if needed, the answer is Mpockket.

You get a loan as small as Rs. 500 up to Rs. 30,000 from Mpockket when required, but remember the APR is a bit high that is ranging from 24% to 72%.

If you are a college student, you have to produce your college ID and last 3 months’ bank statement along with the KYC documents (Aadhar & Pan card) for loan approval.

Pros

- Get credit line as low as Rs. 500

- Offers credit line to college students

- Monthly income is not required

Cons

- Maximum loan amount is extremely low at Rs. 30,000

- High APR as compared to other apps

Conclusion

You can use the Kissht app if your loan requirement is up to Rs. 1 lakh only, because the Kissht app not only has a low APR between 14% to 26% but you can also foreclose or prepay your loan amount without any additional charges. Students can also get a credit line by uploading their College ID proof.

Go with Simpl if you need a few thousand rupees credit line for regular expenses and the best part is your personal information is not shared as no KYC is required with Simpl.

If you need a big loan like 5 lakh or more, go with MoneyTap App because MoneyTap allows you to repay the loan at lower interest rates (starting from 15%), which you can return in a 3 years period.