If you are the primary breadwinner in your family, you must have adequate insurance to avoid a miserable life for your family if you are no more.

Since inflation reduces the value of money over time, it’s better to go for a high life cover amount like 1 crore or 2 crores (depending on your family’s current lifestyle) that would cater to the needs of your family in the future after your demise.

The term plan not only gives you a sigh of relief by protecting your family’s financial needs but also helps you save income tax.

You get a tax rebate against the term plan’s premium paid u/s 80C and the critical illness premiums paid under the term insurance policy save tax for you u/s 80D.

The term insurance death benefit payment received by the nominee is also tax-free under 10D.

Apart from the above-discussed factors, you can learn about how to choose the best term plan buying guide at the end of this article.

However, we have shortlisted 10 best term insurance plans for 1 crore based on 2 major factors along with other features –

- Highest claim settlement ratio (CSR) – Easy claim process

- Higher number of claims provided – Better track record

Let’s start.

Best Term Insurance Plans for 1 Crore in India 2022

#1. Max Life Insurance’s Online Term Plan Plus

Claim Settlement Ratio – 99.22%

Max Life insurance has the highest claim settlement ratio with simple term plans for easy selection.

Max life’s online term plan plus offers you 3 different life cover options –

A. Basic life cover

100% of the sum assured is paid immediately on the death

B. Basic life cover with monthly income

In addition to the 100% of the policy sum assured on the death of the life insured, 0.4% of the cover amount per month for 10 years.

C. Basic life cover with increasing monthly income

Along with 100% of the sum assured which is paid immediately on the death, the family also gets an increasing monthly income at 10% per annum for 10 years, the monthly income shall be 0.4% of the policy sum assured.

For example, if the policyholder takes the “Basic Life Cover plan with Increased Monthly Income” plan for Rs. 1 Crore. If he dies, unfortunately, his family would get Rs. 1 Crore as the death benefit.

His family would also start receiving 0.4% of Rs 1 Crore i.e. Rs 40,000 per month for the next 10 years with a 10% increase every year.

You can go with a critical illness rider to protect against up to 64 diseases such as heart attack, coma, Parkinson’s disease, kidney failure, and many more.

The waiver of premium rider provides an exemption from all future premiums (including riders) in case of any critical illness, loss of body part (Dismemberment), or death (if the Life Insured and Policyholder both are different individuals).

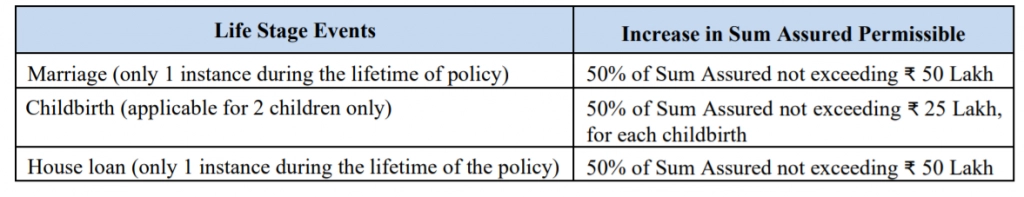

You can also enhance your cover at life’s important milestones by choosing Life Stage Event Benefit as shown below –

Note – Premium amount increases if you select the “increase in sum assured” option.

You can also select to pay the premium till the retirement age (60 years) or for 10 years and enjoy the benefits till the coverage term.

Accident Benefit Rider can be added to get additional coverage if the policyholder dies due to an accident.

Pros

- Low premium

- Enhance life cover at important life stage events like marriage or childbirth.

- 64 ailments covered under critical illness rider

- Monthly increasing payout option along with sum assured

Cons

- No surrender value

- No maturity benefits

#2. HDFC Life’s Click 2 Protect Plus Plan

Claim Settlement Ratio – 99.07%

You can go with HDFC Life’s Click 2 Protect Plus as an alternative to Max Life with a similar CSR percentage and more policy cover options as shown below.

A. Life Option

In case the life assured’s death during the policy term, the family will receive the death benefit as discussed below –

- Single premium pay option – Death benefit is higher than 125% of single premium or Sum Assured.

- Other premium options – Sum Assured is paid

B. Extra Life Option

In the extra life option, the accidental cover equivalent to the sum assured is provided. The policyholder’s family gets 2x Sum Assured in case of accidental death.

C. Income Option

- 10% of the sum assured is paid as the Death Benefit

- The remaining 90% of the sum assured is paid as monthly income over the next 15 years (0.5% of Death Benefit every month for 15 years)

D. Income Plus Option

- 100% sum assured paid as a lump sum to nominees upon policyholder’s death

- In addition, the nominee will also start receiving a monthly income equivalent to 0.5% of the Sum Assured for 10 years. The monthly income can be increasing at 10% p.a. if selected by the policyholder.

Pros

- Multiple premium payment options like single-pay or regular-pay

- 100% accidental death cover with Extra life option

- 36 ailments covered under critical illness rider

- Life stage event protection to enhance sum assured on events like marriage or childbirth.

- Multiple monthly payment payout options are available

- Flexibility to reduce the sum assured after 45 years of age

Cons

- Lesser number of diseases covered

- No maturity benefits

#3. TATA AIA Life Insurance Sampoorna Raksha Supreme Plan

Claim Settlement Ratio – 99.06%

Tata’s Sampoorna Raksha Supreme plan is ideal for you if you need a life cover plan with regular income at old age (above 60 years).

You can avail of the regular income benefit till the policy term ends or the policyholder dies.

Sampoorna Raksha Supreme Plan Death or Survival Benefits

A. Life Option

Complete sum assured amount is paid immediately on the death and if you survive the policy term all the premiums paid will be refunded.

B. Life Plus Option

In Life Plus, you get 50% of the sum assured paid if any terminal illness is diagnosed. You also get back the total premiums paid if you survive the policy term.

C. Life Income

You get the death benefit of lumpsum sum assured payment along with monthly income if you survive the policy tenure.

You have to select between 0.01% to 0.15% of the sum assured as monthly arrears till death. And, you also get an increment of 0.01% every year.

Along with the above benefits, you also get you to get 50% of the sum assured as a terminal illness benefit.

D. Credit Protect

100% sum assured amount is paid immediately on the death and 50% of sum assured paid if any terminal illness is diagnosed.

You don’t get any survival benefit in the Credit Protect option.

Additional Benefits

I. Life Stage Benefit (Available under Life and Life Plus)

You get 4 options to enhance your sum assured to protect important life stage events.

| Event | Additional Sum Assured |

| Marriage (One Marriage Only) | 50% |

| Birth/Adoption of 1st Child | 25% |

| Birth/Adoption of 2nd Child | 25% |

| Home Loan disbursal | 100% of the home loan amount sanctioned |

II. Top-Up Sum Assured (Available under Life and Life Plus)

You get a fixed 5% of basic sum assured increase every year to beat the inflation rate.

III. Health Management Services

In case of any critical illness like cancer or heart attack, you can also avail second medical opinion from any specialist registered or affiliated with the TATA AIA panel at no extra cost.

Important Riders

Non-Linked Comprehensive Protection Rider

You can enhance the life cover for various unforeseen tragedies like

- Death or permanent disability due to an accident – 2x of sum assured

- Any critical illness – 40 ailments covered including the heart problem and cancer

You get the flexibility to choose benefits as a combination of

- Lump-sum and regular income for a fixed period

- Income till the partner survives

- Waiver of future premiums

You can also seek expert advice from global specialist consultation services for 3 months if heart disease or cancer is diagnosed.

Pros

- Regular income with life cover

- Life stage event protection also includes Home loan

- 50% paid of life cover paid if terminal illness diagnosed

- Monthly increasing payout option available

- An annual increase of 5% against basic sum assured (optional)

- Free of cost medical expert opinion if heart disease or cancer diagnosed

Cons

- No sum assured reduction option available

- Suicidal death or disability is not covered

- Very low monthly income percentage

Check out – Best family health insurance plans in India

#4. Bajaj Allianz Life Insurance Smart Protect Goal Plan

Claim Settlement Ratio – 98.02%

You can go for Bajaj Allianz’s Smart Protect Goal if you need a term plan with maturity benefits. Maturity benefit means you will get back all the premium paid if survive the policy term.

Smart Protect Goal Plan Benefits

I. Return of Premium (ROP) – You will get all the premium paid back if you survive the policy term.

II. Whole of Life – Life covers up to 99 years of age.

Riders Benefits

A. Accidental Death Benefit (ADB)

If you avail the rider, you get an additional sum assured (as selected) in case of death due to an accident.

B. Accidental Total Permanent Disability Benefit (ATPDB)

You get the selected amount in case any permanent disability occurs due to an accident.

C. Critical Illness Benefit (CIB)

- Similar to the above benefits, you get the cover finalized in case of major critical illness (CI).

- For any minor CI other than Angioplasty, 25% of the CIB cover is paid.

- For Angioplasty, Rs. 5 lakhs or 25% of CIB (whichever is lower) is paid.

Pros

- Return of premiums if the policyholder survives the policy term

- Critical illness, Permanent disability, and Accidental death riders available

- Single payment option available

Cons

- No increasing sum assured benefit

#5. ICICI Prudential iProtect Smart Term Insurance Plan

Claim Settlement Ratio – 97.84%

ICICI Prudential iProtect Smart is ideal for you if you are looking for a comprehensive term plan with surrender benefits. That means at any point in time you want to stop the policy, you will get a portion (around 70% of the sum assured) of your paid premiums back.

You get 3 ‘Death Benefit’ payout options –

I. Lump-sum – the entire sum assured amount is paid as a lump sum to the nominee.

II. Regular Income – The nominee will start receiving 10% of the death benefit per month for 10 years. For example, if life cover is Rs 1 crore, your nominee would start receiving Rs 83,333 per month for 10 years. Your nominee can also ask to get the complete first year’s income as a lump sum.

III. Increasing Income Option – 10% of the death benefit amount is payable to the nominee every year for 10 years with an increase of 10% p.a. For example, if the sum assured is Rs 1 crore, your family will receive Rs 83,333 per month in the 1st year, in the 2nd year Rs 91,667 per month (Rs 83,333 + 10% of 83,333), and so on for the next 10 years.

Other No Extra Cost Benefits

A. In-built terminal illness benefit

You get a full claim payout if diagnosed with any terminal illness without paying any extra cost because iProtect smart has an in-built terminal illness benefit so you need not pay extra on the rider.

B. In-built permanent disability waiver

In case the policyholder faces permanent disability due to an accident, all the future premiums will be waived off but the life cover will continue. And again you need not pay extra because the feature is inbuilt in the plan.

Important Riders

#1. Accidental Death Benefit Rider

You can add on accidental death benefit rider up to Rs 2 crore to enhance financial cover if death happens due to an accident.

#3. Accelerated Critical Illness (ACI) Benefit Rider

You can also add ACI rider to get cover from 34 critical ailments like Cancer, Heart disease, you can claim up to 25% of the sum assured amount for the treatment of the disease, and the rest of the amount will be continued as life cover.

For example, if you have a life cover of 1 crore, you discovered a critical disease, then you can claim up to 25 lakh rupees for the treatment, and the rest of the 75 lakh rupees would remain intact for the life cover.

Pros

- Low premium

- 34 ailments covered under critical illness rider

- In-built terminal illness and disability waiver benefits

- Monthly payout with regular and increasing payout options available

- AIDS and suicidal death also covered

Cons

- Less number of ailments covered

Also check – How to make smart investment portfolio

#6. LIC’s Tech Term Plan

Claim Settlement Ratio – 96.69%

If you are a LIC fan and want to go with a low premium 1 crore term insurance plan, then go with LIC Tech Term Plan.

LIC has introduced this plan for people who need high insurance cover as the plan starts from 50 lakh sum assured.

However, you would miss the critical illness rider that helps in the treatment of any severe ailment that occurs.

You get two “Death benefit” options –

I. Level Sum Assured

The sum assured remains the same throughout the policy tenure as decided at the time of policy start.

II. Increasing Sum Assured

The sum assured amount remains the same till the 5th policy year and from the 6th year till the 15th policy year, the basic sum assured amount increases by 10% to reach the 2X of the basic sum assured.

From the 16th year onwards till the end of policy tenure or death of the policyholder the life cover amount remains the 2X of basic sum assured.

For example, If you start LIC Tech term policy with a basic Sum Assured of Rs. 1 crore, your life cover will remain Rs. 1 crore till the end of the 5th policy year.

In the 6th year, the life cover would be Rs. 1.10 crore. And 1.20 crore during the 7th policy year, because of an increment of 10% per year till the 15th policy year.

And the final sum assured amount would be 2 crores till policy end or death of the policyholder.

III. Payout Options – Lumpsum or Installments

You can also select the payout whether the nominee will get a lump sum amount or in installments.

You can select the installment period from the three options available – 5 or 10 or 15 years.

Note – The Death Benefit option cannot be changed once the policy started.

Riders

You can add an Accident Benefit Rider to get additional death cover if the policyholder dies due to an accident.

Pros

- Low premium

- Enhance life cover at important life stage events like marriage or childbirth.

- 64 ailments covered under critical illness rider

- Monthly increasing payout option along with sum assured

Cons

- No surrender value

- No maturity benefits

Also check – Best instant loan app without salary slip

#7. Reliance Nippon Life Protection Plus

Claim Settlement Ratio – 98.14%

Reliance Nippon Life Protection Plus is ideal for someone looking for a low premium 1 crore plan and doesn’t want any additional riders.

Life Protection Plus has 4 options –

I. Level Cover Plan

You can fix a sum assured at the beginning of the term plan and that will be paid to the nominee if the life insured dies.

II. Increasing Cover Plan

Your sum assured increases at 10% every 5th policy year throughout the policy tenure to reach 2x sum assured amount.

For example, if you get a policy with a sum assured of 1 crore, your policy sum assured will increase every 5th year till it reaches the 2 crore amount.

In case the policyholder dies, the nominee will get the enhanced amount of sum assured accumulated till the date of death.

III. Life Plus Income Plan

In the Life Plus Income plan, the family receives the 100% sum assured if the policyholder dies during the policy term.

And the family also starts getting 1% of the sum assured per month for the next 10 years.

For example, if you have bought a Life Plus Income plan with a sum assured of 1 crore. In case you die, your family will get 1 crore immediately and they will start getting 1 lakh (1% of sum assured) per month for the next 10 years.

IV. Whole of Life Cover

You have to pay the premiums till 65 years age but you get a life cover up to 99 years. In case, if the death of the policyholder happens post 65 years of age, the nominee will get the sum assured amount.

Pros

- Competitive premium prices

- Income plan that ensures double benefit of lumpsum payment and monthly income

- Whole life cover to provide cover even after you stopped paying premiums

Cons

- No riders available

#8. Aditya Birla Sun Life Insurance DigiShield Plan

Claim Settlement Ratio – 97.54%

You can go with ABSLI DigiShield term insurance if you want a variety of plans to select from. Because you get 10 life cover options to select the plan that fulfills your needs.

| #1. Level Cover Option | You can choose a sum assured amount that would remain fixed throughout the policy term and the nominee will get the lump-sum amount if the policyholder dies. |

| #2. Increasing Cover Option | You can choose the basic Sum Assured and increment option of 5% or 10% of the sum assured that will increase every year during the policy tenure. In case the policyholder dies, the nominee will get the lump sum life cover amount of that policy year. |

| #3. Sum Assured Reduction Option | You can select the option to reduce the basic Sum Assured by 50% or 25% when you reach old age. You can start life cover reduction from 60 years, 65 years, 70 years, or 75 years. The sum assured will keep on reducing till the end of the policy term. In case the life insured dies, the nominee will get the lump sum assured amount of that policy year (if reduced). |

| #4. Whole Life Option (Level Cover) | You can get a whole life cover protection till 100 years of age by paying premiums till the age of 65 years. |

| #5. Whole Life Option (Sum Assured Reduction Cover) | You can take life cover till 100 years along with benefits of sum assured reduction by 50% or 25% when cross 60 years age. You can choose reduction anytime on completing 60 years, 65 years, 70 years, or 75 years. |

| #6. Income Benefit | Under this option, if the policyholder dies, the nominee will start receiving monthly income equivalent to 1.25% of the Sum Assured per month. You can choose the benefit period of 10 years, 15 years, or 20 years. The monthly income will increase at 5% p.a. during the chosen income benefit period. |

| #7. Level Cover Plus Income Benefit | If the death of the life insured occurs, the nominee will get a lump-sum assured amount immediately. Along with, 0.5% of monthly income paid for 10 years. |

| #8. Low Cover Option | If you need an instant life cover at a low premium, then Low Cover is the best option. But you’ll get a low sum assured and a small policy term plan to choose from. You can take life cover starting from 1 lakh up to 25 lakh. And the policy term is a maximum of 4 years. |

| #9. Level Cover with Survival Benefit | If you cross 60 years of age and your policy term is not over, you’ll get a Survival Benefit equal to 0.12% of the sum assured paid on monthly basis till the policy term. If the life insured dies during the policy tenure, the nominee will receive the absolute amount. Absolute amount = Sum Assured – Survival Benefit already paid |

| #10. Return of Premium (ROP) | If you survive the policy term, you get back all the premiums paid throughout the policy tenure. |

Additional Benefits

A. Terminal Illness Benefit

If you diagnose with any terminal illness before 80 years of age (if the policy term is 100 years), you get 50% of the Sum Assured (up to a maximum of Rs. 2 crores) immediately and your future due to premiums will be waived off.

So you don’t have to pay the future premiums but your policy will continue. However, now your life cover amount will be reduced by the amount paid as Terminal Illness Benefit.

B. Accelerated Critical Illness (ACI) Benefit

If you have to undergo treatment of any critical illness like heart surgery, you can get a minimum of 5 lakh or 50% of the Sum Assured (up to a maximum of Rs. 50 lakh) immediately.

You have to fix the ACI benefit amount at the start of the policy.

But your life cover amount will be reduced by the amount paid as ACI Benefit.

The maximum ACI benefit age is 70 years.

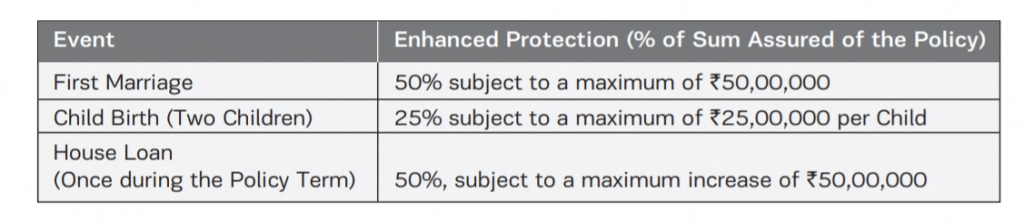

C. Life Stage Enhancement Benefit

You get the life cover enhancement option to avail at important life events as below –

Important Add-on Riders

I. Accidental Death and Disability Rider

You get a maximum of 50 lakh life cover if the policyholder dies or gets a permanent disability due to an accident.

II. Waiver of Premium Rider

Your future premiums will be waived off if you can’t pay your premium because of financial difficulties.

Pros

- Multiple policy options to select from

- Survival and monthly income benefits are available

- Terminal or critical illness benefits within the plan

Cons

- Increase in cover against home loan amount is restricted to 50%

- Montly payment option is limited to 0.5% only

#9. PNB MetLife Mera Term Plan Plus (Joint Life Insurance)

Claim Settlement Ratio – 97.18%

You can also opt for PNB MetLife Mera Term Plan Plus to include your spouse within your life cover.

The maximum life cover of your partner would be 50% of your basic sum assured.

In case the first life insured dies, the sum assured fixed for the first life is paid to the nominee. The second life cover continues with all future premiums are waived off.

If the second life insured dies, then 2nd life’s fixed sum assured is paid to the nominee. Now the premium of 1st person is reduced as per the guidelines.

But the issue with joint term insurance is that you can’t add any rider if you are opting for a joint term plan.

Major Benefits of PNB MetLife Mera Term Plan Plus

I. Child Education Cover

You can enhance your life cover to protect your kid’s future education expenses if you are no more.

You can get the additional sum assured in the range of Rs. 10 lakh up to a maximum of Rs. 1 crore.

The education cover is calculated based on the present annual education cost. You can opt for this option only if your child has 5 to 19 years of education (till graduation) is left.

II. Life Cover

Lumpsum amount of sum assured is paid to the nominee on death of the policyholder

III. Life Plus

You get a cover against death or disability due to accident plus terminal illness. That means a lumpsum amount is paid to the family in case accidental death, disability, or terminal illness is diagnosed.

Along with that, your future premiums are waived off in case any accidental permanent disability or diagnosis of any terminal illness like cancer occurs.

IV. Life plus Health

You get a cover against death or disability due to accident plus terminal illness. You also get an accelerated critical illness cover that offers payment of up to 25% of the sum assured for treatment.

The rest 75% of the sum assured will be remained as life cover throughout the policy term.

V. With Return of Premium

You can receive all your paid premiums if you survive the policy term.

Pros

- Joint life protection under a single plan

- Child education cover

- 25% payment on critical illness diagnosis

- Return of premium on survival

- Waiver of premium benefit available

Cons

- 50% of primary sum assured is fixed for joint life cover

- No additional benefit like critical illness is available for second life cover

#10. SBI Life Insurance eShield Term Plan (LIC Alternate)

Claim Settlement Ratio – 94.52%

You can go with SBI Life’s eShield plan if you are looking for a LIC alternative because you get similar benefits with the trust of SBI bank.

You get two “Death benefit” options –

I. Level Cover Benefit

Your sum assured amount remains the same throughout the policy tenure and the nominee will get that cover amount if the policyholder dies.

II. Increasing Cover Benefit

Your sum assured increases at 10% every 5th policy year throughout the policy tenure.

Other Major Benefits

A. Terminal Illness Benefit

If the policyholder is diagnosed with a terminal illness, the sum assured would be paid and the policy will terminate.

B. Medical Second Opinion

You may get a free medical second opinion from World Leading Medical Centers affiliated with SBI Life.

C. Add on Riders

Accident Benefit Rider & Permanent Disability Rider to get additional cover if the policyholder dies or permanent disability happens due to an accident.

Pros

- Simple and easy life cover options

- Increasing life cover every 5 years

- Second medical opinion benefit

- Terminal illness benefit

Cons

- No second medical opition for acute or life-threatening condition

- No maturity benefits

- No policy surrender benefits

How to Choose the Best Term Insurance Policy

#1. How Much Cover Required

While deciding how much cover you require you must consider the things below –

- Monthly expenses

- Outstanding loans

- Future expenses like child education, marriage.

You can use the thumb rule of having an insurance cover that is 20x of your annual income and any outstanding debts. (Most experts ask to go with 10x, but keeping inflation in mind, you should consider going with 20x amount.)

You should also consider inflation in mind because that erodes the value of your money. The enhanced cover may not provide complete protection against inflation but still, it will reduce the impact of inflation to protect your money’s real value.

For example, if your annual income is Rs. 5 lakh, your insurance cover requirement would be Rs. 1 crore.

If you are no more, the 1 crore insurance amount would cover all the 3 points – monthly bills, pending loans, and big expenses.

#2. Start Term Insurance at Early Age

The term plans are ultra-cheap if started at a young age. A 30-year-old man will hardly pay Rs 10,000 annually for a 1 crore insurance cover till the age of 70.

Delaying the term insurance cover purchase increases the overall premium cost. So it’s always recommended to start a term plan as early as possible if you have dependent family members.

#3. Choose the Right Tenure

You buy term insurance to protect your family from the financial crutch that they may face if you are no more. So, the term insurance gives you time to build your investment corpus that would take care of your financial needs when you are retired.

The right term for term insurance is the time you need to build your wealth down the lane or you can simply keep your retirement age as the term period.

For example, if your current income is 5 lakh per annum and you have investments of 5 lakh.

And you think in the next 30 years, you would be able to build sufficient wealth that would take care of your family’s monthly expenses, liabilities like child’s marriage, and your retired life, then your term for the insurance should be 30 years.

Take a cover till the age of 65-70 years because most of your liabilities would have already been covered by that time.

#4. Choose the Right Term Insurance Plan Types

I. Basic term plans

Basic or Level term plans are simple plans in which the sum assured remains fixed throughout the tenure of the plan. In case the policyholder dies, the fixed sum assured amount is paid to the family.

II. Increasing cover plans

Increasing cover plans are designed to cope up with inflation to some extent.

In increasing cover insurance plans, the selected sum assured amount increases every year by a fixed percentage. In case of death, the cover amount which is applicable in the year of death is paid.

For example, if the sum assured of your term plan is Rs. 20 lakh that increases 5% every year. The cover amount of your policy in the second year would be Rs. 21 lakhs. In the 3rd year, the cover would increase to Rs. 22.05 lakhs, in the 4th year it would become 23.15 lakhs and so on.

If the policyholder dies in the 4th policy year, Rs.23.15 lakhs would be paid against the claim despite the initial sum assured amount was Rs. 20 lakh.

III. The Return Of Premium plans or TROP

TROP plans come with maturity benefits. Apart from death benefits, if the insurer survives until term insurance tenure, the policyholder’s premiums are refunded.

TROP plans are ideal for individuals who want life insurance with maturity benefits.

#5. Additional Riders to Look for

Riders are add-on plans that enhance the benefits and functionality of basic term plans. But you have to pay an additional amount (nominal amount) to avail of the benefits.

I. Accidental death benefit rider

Under accidental death rider, insurance companies pay an additional sum assured amount to the family if the policyholder dies in an accident.

In case of a non-accident death, the term insurance sum assured will be paid.

II. Critical illness benefit rider

A critical illness benefit rider offers a lump sum payment to the policyholder if diagnosed with a terminal or life-threatening disease such as cancer, heart attack, paralysis, kidney failure, or other critical illness.

Your family can utilize the payout amount to meet their financial needs or clear outstanding debts.

III. Waiver of premium rider

With this rider, future premiums are waived off if the policyholder is not able to pay the insurance premium because of any disability or income loss.

If you don’t opt for this rider, at any point in life when you are not able to pay future premiums (due to disability or job loss), your policy will lapse.

The waiver of premium rider doesn’t cost much but watch out for exclusions.

The future premiums won’t be waived off if you are diagnosed with a critical illness or suffers permanent disability under conditions below –

- Pre-existing Medical Condition.

- Hereditary Diseases.

- Participation in Dangerous Activities.

- Participation in War, Riots, Civil Commotion.

- Participation in Unlawful Activities

- Self-Inflicted Injuries.

- Suicide

- Driving under the influence

- Drug Abuse

IV. Income benefit rider

The rider offers additional regular income to the family if the policyholder dies along with the sum assured payout.

You can fix the regular income tenure to 5 to 10 years so that your family can maintain their current lifestyle without any problem.

#6. Claim Settlement Ratio

Remember a simple rule – the higher the CSR value, the easier would be the claim settlement process. So always compare the insurance company’s CSR values before buying a new policy.

Claim Settlement Ratio of Top 10 Term Insurance Companies in India

| Insurance Company | Claim Settlement Ratio 2019-20 | No. of Claims Paid 2019-20 |

| Max Life Insurance | 99.22% | 15342 |

| HDFC Life Insurance | 99.07% | 12509 |

| Tata AIA Life Insurance | 99.06% | 2954 |

| DHFL Pramerica Life Insurance | 98.42% | 560 |

| Exide Life Insurance | 98.15% | 3404 |

| Reliance Life Insurance | 98.14% | 7866 |

| Canara HSBC Life Insurance | 98.12% | 1252 |

| Bajaj Allianz Life Insurance | 98.02% | 11887 |

| Aegon Life Insurance | 98.01% | 344 |

| ICICI Prudential Life Insurance | 97.84% | 11212 |

(Source: IRDAI Annual Report – Claim Settlement Ratio for the year 2019-20)

#7. Multiple Payout Options

Insurance companies offer various death benefit payout options to the policyholder’s family –

- Single payment

- Annual

- Semi-annual,

- Quarterly,

- Monthly basis

You can decide the payout option that you feel is ideal to fulfill your family’s needs.

We suggest you opt for a single payment option so that your family has all the money and they can safely invest to get a regular interest on it.

Conclusion

You can go with Max Life’s Online Term Plan Plus if you want an easy claim process and a low premium for 1 crore or above life cover.

ICICI’s iProtect is a good term plan that offers in-built terminal illness and critical illness benefits so you don’t have to pay extra money on riders.

If you want a term plan that offers you a truckload of options to select with, then go with Aditya Birla Sun Life Insurance DigiShield Plan that will provide you 10 different life cover options to finalize the best term plan as per your needs.